Join the millions of customers banking through One

Enter your number to download the app and get started. Messaging rates may apply.

One is a financial technology company, not a bank.Banking services provided by Coastal Community Bank, Member FDIC.

One is a financial technology company, not a bank.Banking services provided by Coastal Community Bank, Member FDIC.

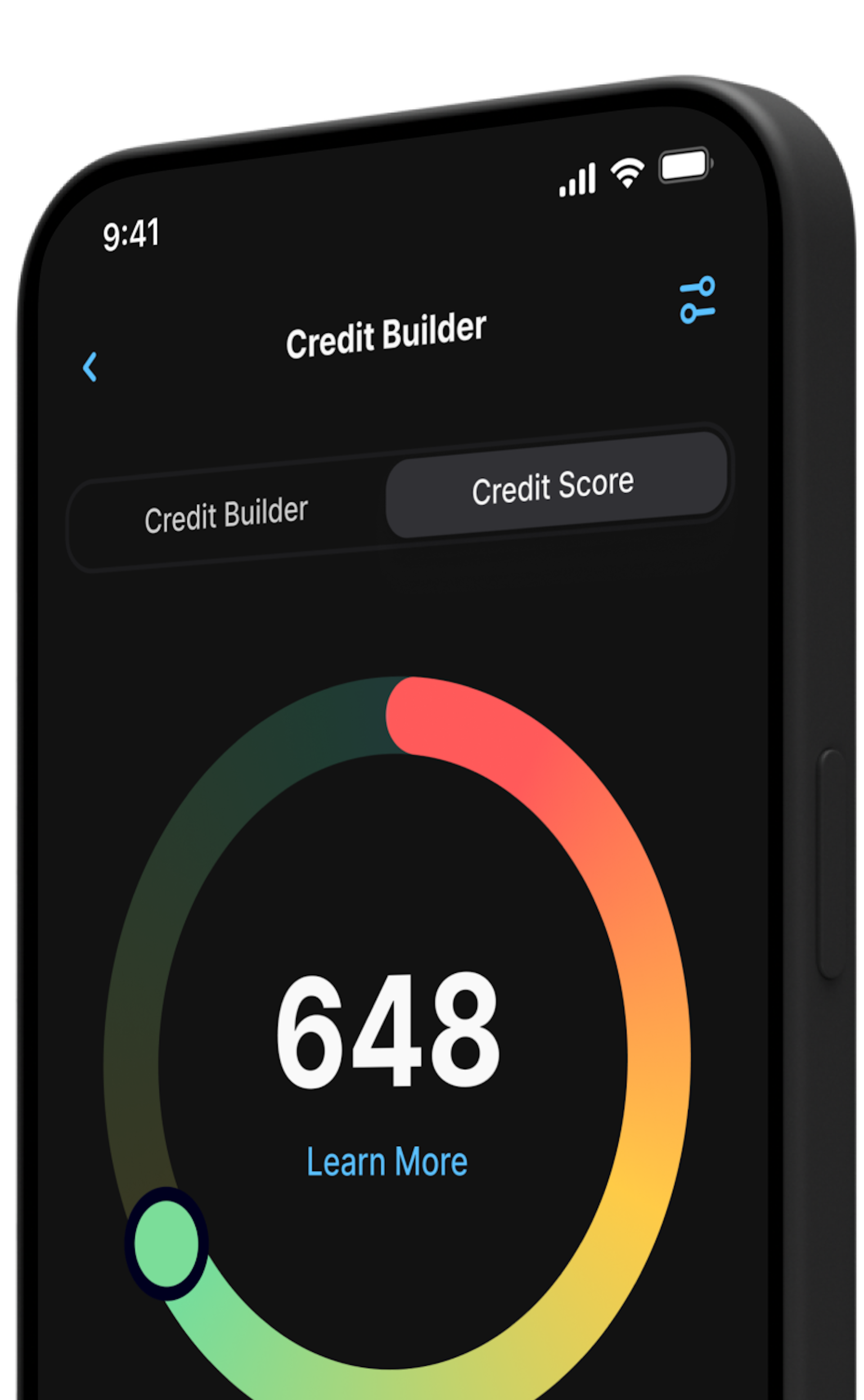

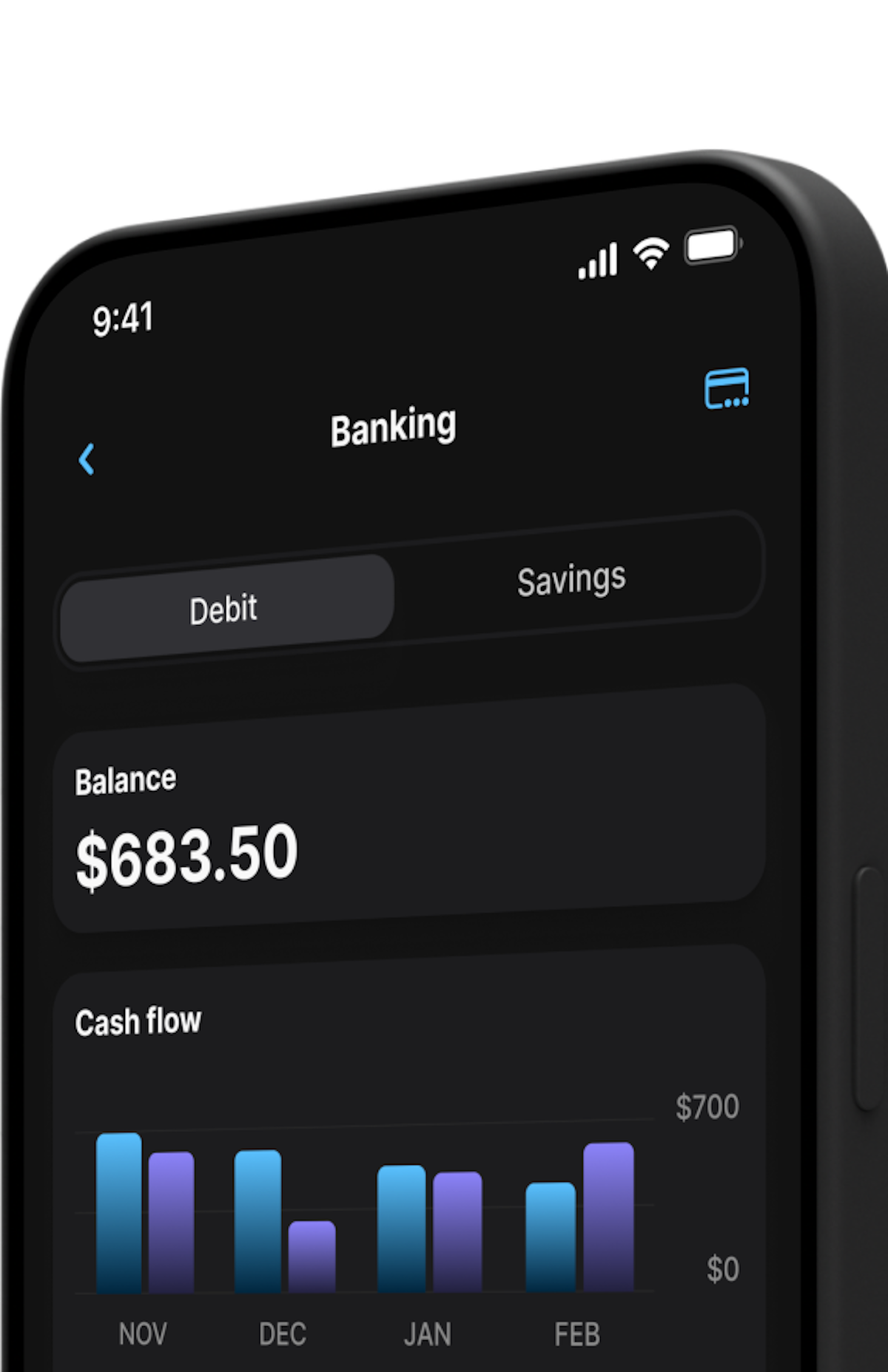

Mobile Banking

Banking for the better

Debit Rewards, early pay,1 high-yield Savings, and no monthly fees.

On select brands.

5.00% APY on Savings3

With eligible deposits.

Get paid up to 2 days early1

With direct deposit.

No monthly fees

Or minimum balances.

No better way to shop at Walmart

Mobile Banking

3% cash back at Walmart4

Up to $50 every year, with eligible deposits.

Mobile Banking

3% cash back at Walmart4

3% cash back at Walmart, up to $50 every year, with eligible deposits. See terms for eligibility.4

Mobile Banking

Add or take out cash at Walmart

Mobile Banking

Add or take out cash at Walmart

Available at any Walmart with your One debit card or app.6

Why we're the One customers love

“I've been using this app for 7 months now and it's great. I can transfer money easily...It shows my every transaction...It's very easy to use.”

APP STORE® REVIEW

See how One stacks up

When it comes to Spending and Saving, we're the One raising the bar.

| One | Chime* | Chase* | Bank of America* | |

|---|---|---|---|---|

| Monthly Fees | $0 | $0 | $12 | $12 |

| Overdraft Fees | $0 | $0 | $34 | $10 |

| Early Pay* | ||||

| 3% Cash Back at Walmart | ||||

| APY* | 5.00% | 2.00% | 0.01% | 0.01% |

Comparison as of 01/16/2024

There's more to love about One

Mobile Banking

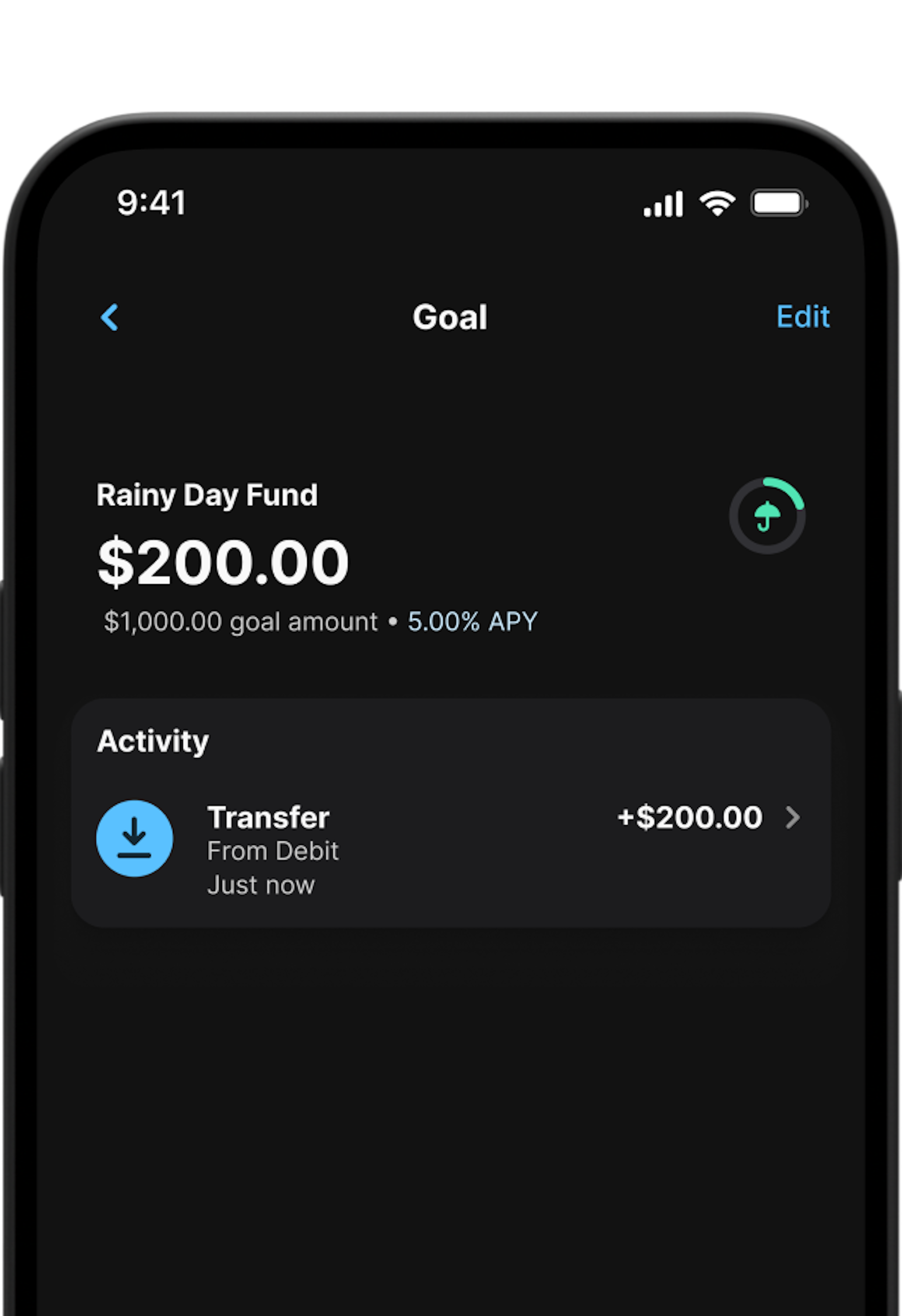

Save smarter with Goals

Create up to 3 Goals to help you save.

Mobile Banking

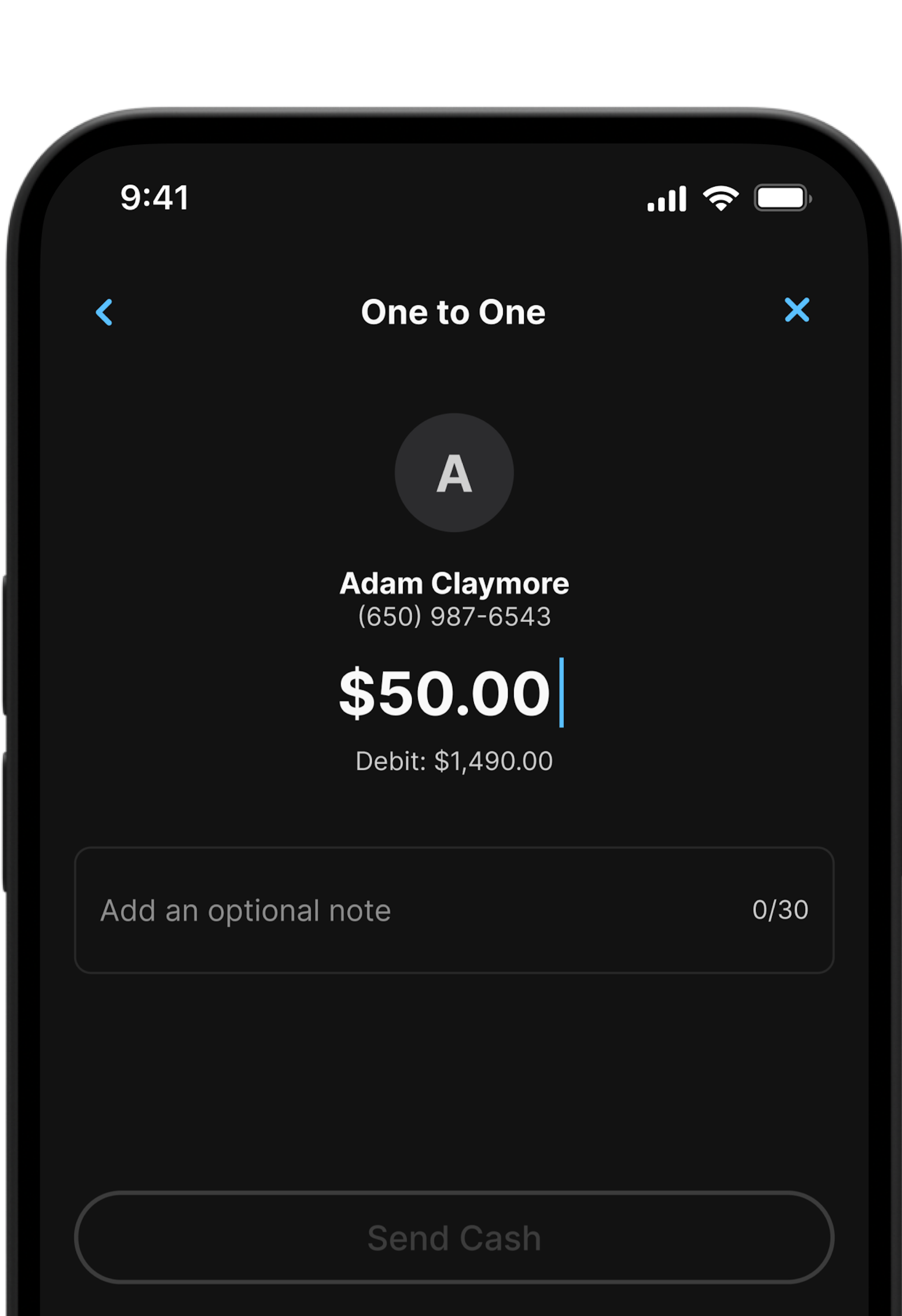

Send money to anyone — easily

A quick and free way to move money.6

Join One today

Debit Rewards, early pay,1 high-yield Savings.

Download the appEnter your number to download the app and get started. Messaging rates may apply.